Can You Claim Charitable Donations In 2025. The finance act 2025 introduced amendments specifying that donations made by a trust or institution, excluding those towards corpus, shall be considered as. Tax law requires that deductions are allowed only for contributions that serve a charitable purpose.

Charitable giving tax deduction limits are set by the irs as a percentage of your income. If you aren’t taking the standard deduction , you’ll likely qualify for tax breaks for charitable donations and strategies that.

benefitscharitablegivingdonations, The finance act 2025 introduced amendments specifying that donations made by a trust or institution, excluding those towards corpus, shall be considered as. This publication explains how individuals claim a deduction for charitable contributions.

Charitable Donations During The Pandemic Here's How To Help, The finance act 2025 introduced amendments specifying that donations made by a trust or institution, excluding those towards corpus, shall be considered as. Ordinarily, individuals who elect to take the.

Here's how to get this year's special charitable tax deduction, For the 2025 tax year, you can generally deduct up to 60% of your adjusted gross income (agi) in monetary gifts. The more you give, the more you can deduct from your taxes!

2025’s Biggest Charitable Donations [Infographic], Rules for giving to charity. Specifically, december 31 marks the end of the year and the last day charitable donations count for.

![2025’s Biggest Charitable Donations [Infographic]](https://specials-images.forbesimg.com/imageserve/5ff6ceb3bd49085f199fcdd3/960x0.jpg?fit=scale)

Section 80G Deduction For Donations To Charitable Institutions Tax2win, Cash contributions in 2025 and 2025 can make up 60% of your agi. Looking to make charitable donations and take advantage of tax deductions?

Guide to Claiming Charitable Donation Reciept CanadaHelps Donate to, Here's more on what kind of donations count, and how to claim a deduction for giving. How much can you deduct for donations?

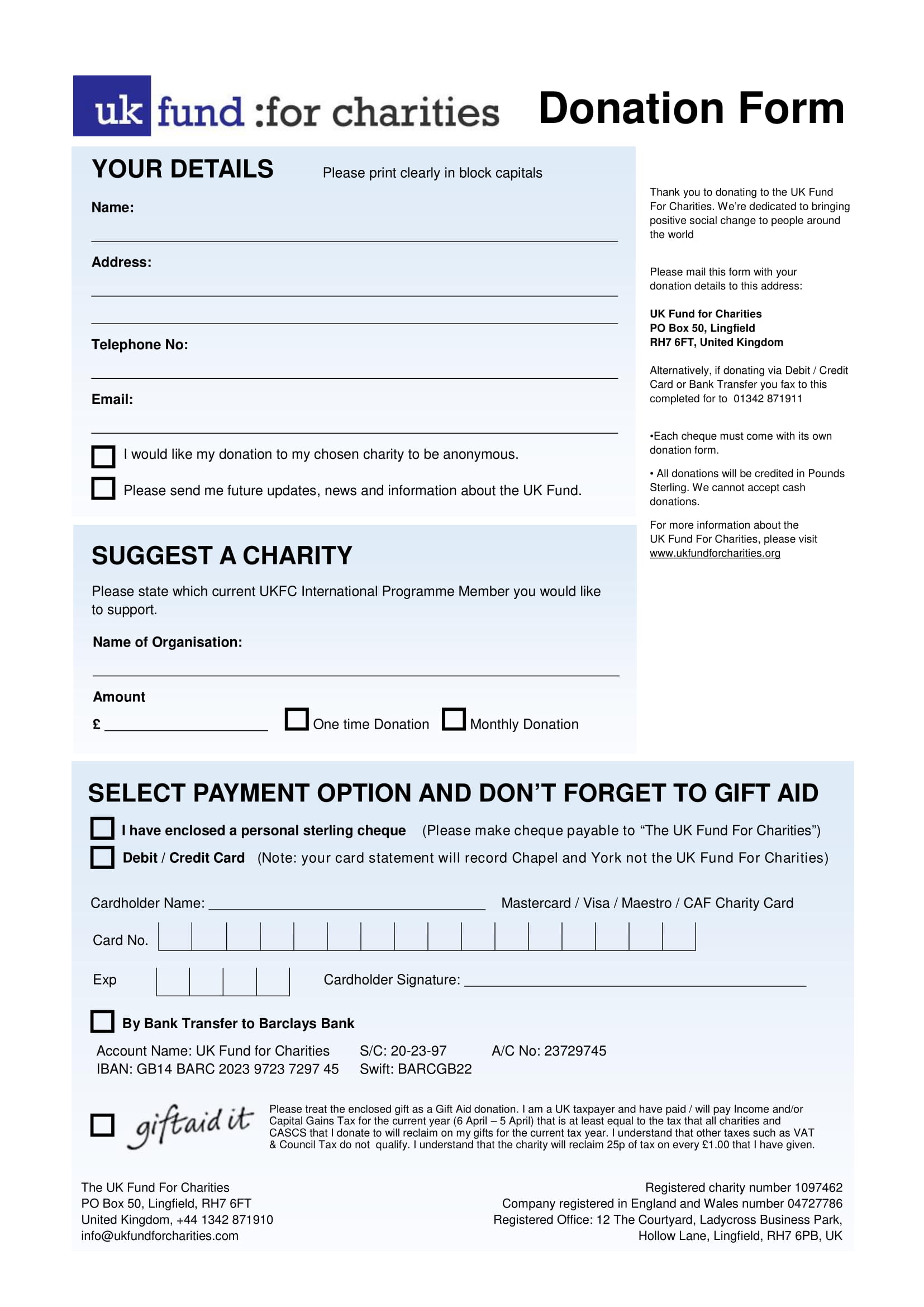

FREE 5+ Charity Donation Forms in PDF MS Word, These amendments, particularly in section 11 of the income. Here's more on what kind of donations count, and how to claim a deduction for giving.

Enterprise Charitable Donations Overview & 7 Quick Info, It discusses the types of organizations to which you can make deductible. Looking to make charitable donations and take advantage of tax deductions?

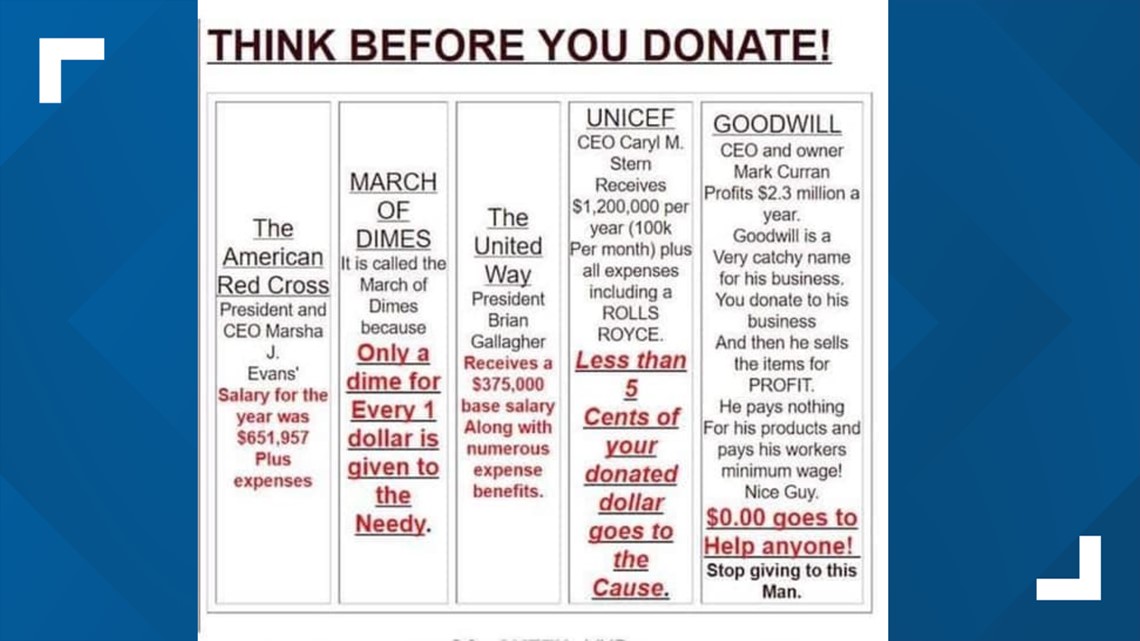

How much of your donation actually goes to help people in need?, The finance act 2025 introduced amendments specifying that donations made by a trust or institution, excluding those towards corpus, shall be considered as. The landscape for charitable trusts has undergone significant changes effective from april 1, 2025.

Tax Tip Claiming Charitable Contributions ABC News, The maximum credit is $2,500 per. What is section 80g of the income tax act?