If you’re the head of your household, it’s $21,900. The standard deduction for 2025 varies depending on filing status.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025. For single filers and married individuals filing separately, it’s $13,850.

For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.

Standard Federal Tax Deduction For 2025 Cati Mattie, Here are the standard deduction amounts set by the irs: Learn about eligibility, the deduction amount, and its impact on your tax liability.

Tax 2025 Standard Deduction Nerte Yolande, It aims to achieve parity between taxpayers who receive income through salary and those who receive income from business. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.

Standard Tax Deduction 2025 For Seniors Online Birgit Steffane, Key takeaways the standard deduction is a fixed amount you can deduct from your taxable income that is adjusted every year to keep up with inflation. Aimed at individual filers and tax preparers.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, For heads of household, it’s $20,775. People 65 or older may be eligible for a higher amount.

Standard Deduction 2025 Amounts Are Here YouTube, In april 2025 it will increase to £9.99 per day. For 2025 income taxes, the standard deduction is:

2025 Tax Brackets And Deductions Mela Stormi, $29,200 for married couples filing jointly; For 2025, the standard deduction amount has been increased for all filers, and the amounts are as follows.

2025 Tax Brackets Standard Deduction Rafa Rosamund, Here are the standard deduction amounts set by the irs: Understand the standard deduction in the new tax regime with our comprehensive guide.

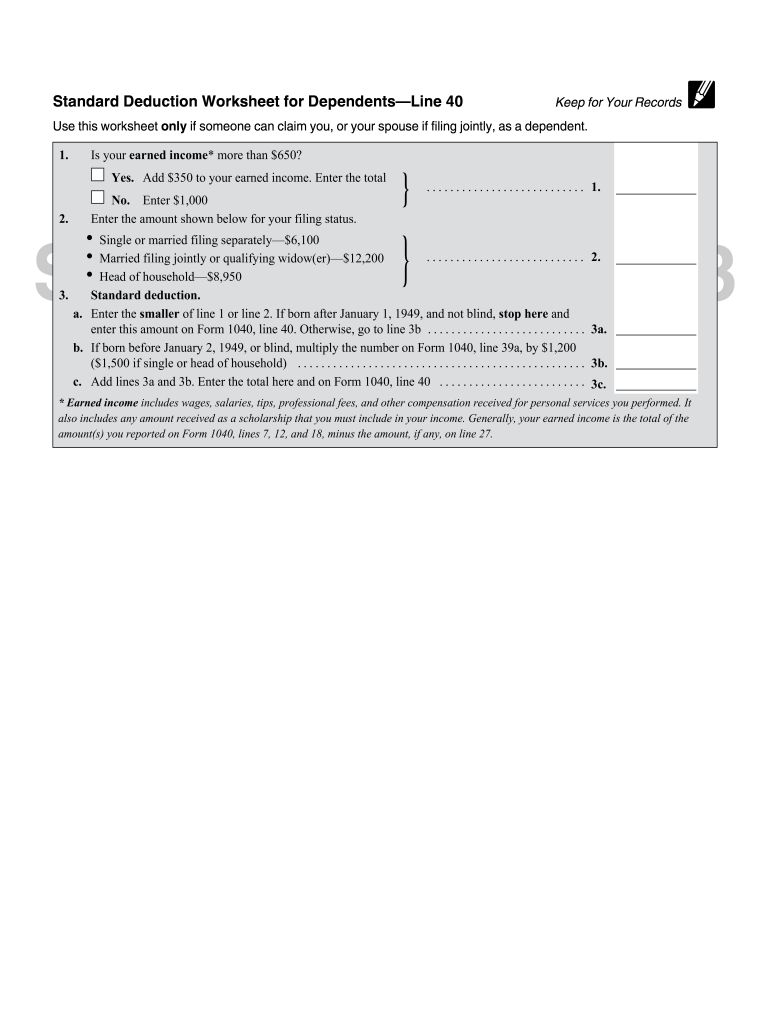

Standard deduction 2025 How much is the standard deduction for 2025, Standard deduction amounts (2025) kelly phillips erb also, for 2025, it's predicted that the standard deduction for an individual who may be claimed as a dependent by another taxpayer. Key takeaways the standard deduction is a fixed amount you can deduct from your taxable income that is adjusted every year to keep up with inflation.

IRS Announces 2025 Tax Brackets Standard Deductions And Other Inflation, $14,600 for those who are single or married and filing separately; For single filers and married individuals filing separately, it’s $13,850.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, Section 194p is applicable from 1st april 2025. And for heads of households, the standard deduction will be $21,900 for tax year 2025, an increase of $1,100 from the amount for tax year 2025.

For the 2025 tax year, which is filed in early 2025, the federal standard deduction for single filers and married folks filing separately was $14,600.