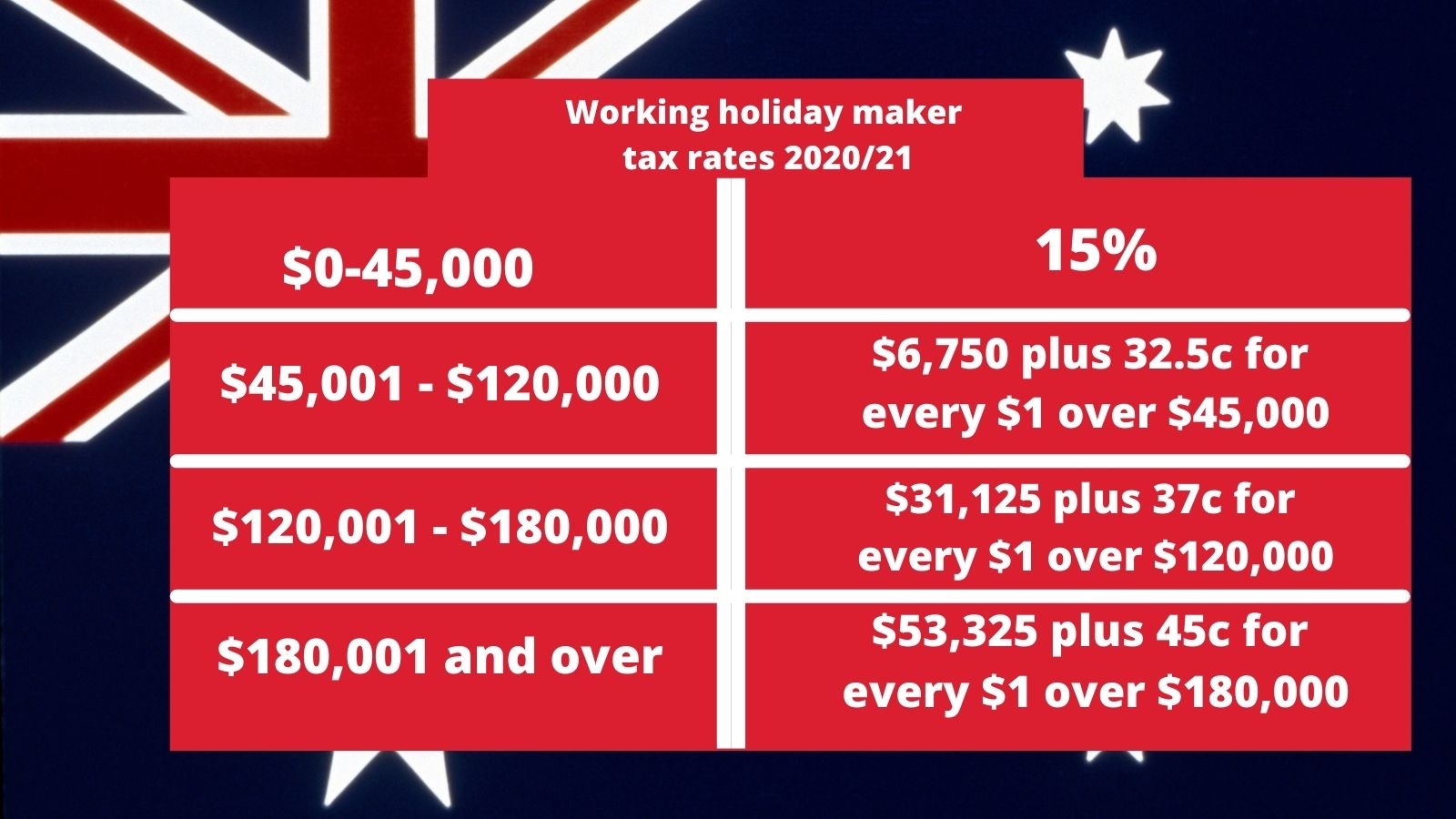

Working Holiday Tax Rate 2025. The union budget 2025 will be presented on 23rd july, with the session running from 22nd july to 12th august. Should you travel to australia as a working holiday maker either on a 417 (working holiday) or a 462 (work & holiday) visa, the first $45,000 of your income is taxed at 15% and the.

The union budget 2025 will be presented on 23rd july, with the session running from 22nd july to 12th august. Working holiday makers in australia, holding either a 417 or 462 visa, are subject to a flat tax rate of 15% on their earnings up to $45,000 for the income year 2025.

Tax rates for holiday visa makers (2025/2025) working holiday visa makers (subclasses 417 & 462) are under a specific tax system.

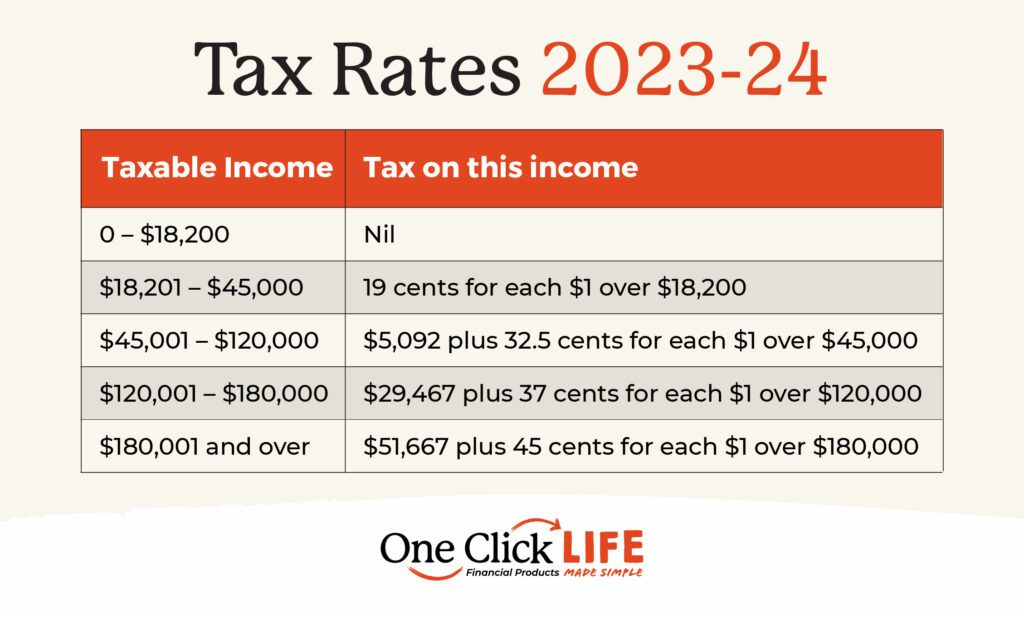

2025 Tax Brackets One Click Life, Use the income tax estimator to. Use the simple tax calculator to work out just the tax you owe on your taxable income for the full income year.

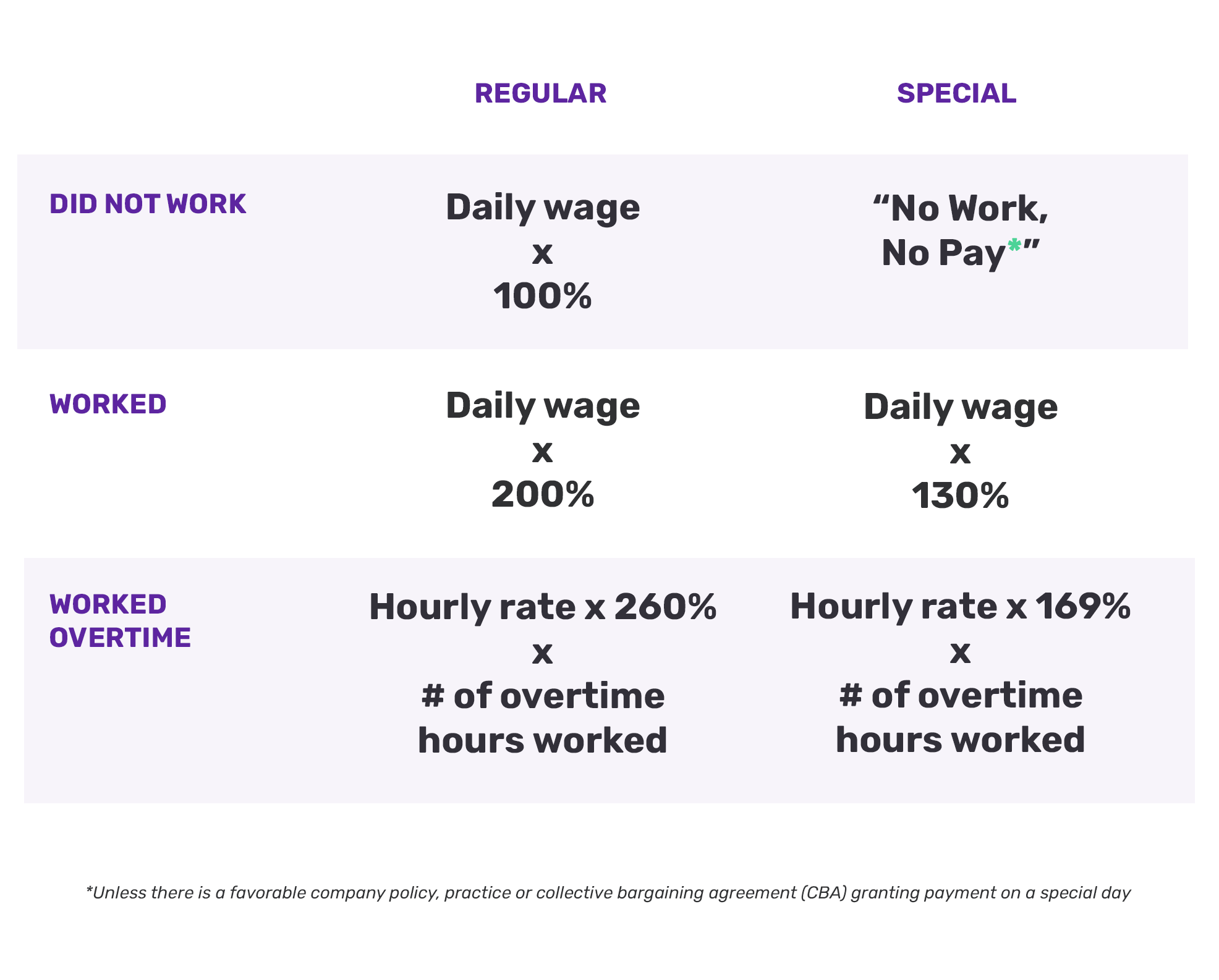

Working Days In 2025 In Philippines Koo Mirabel, All segments, including the equity. If you’re on a working holiday in australia, you’ll be expected to pay tax on any earnings.

working holiday tax introduction YouTube, Tax rates for holiday visa makers (2025/2025) working holiday visa makers (subclasses 417 & 462) are under a specific tax system. Income range and tax rate when working for an employer registered as an “employer of working holiday makers”.

Your Ultimate Guide to Australian Working Holiday Taxes, All segments, including the equity. They are taxed on a.

Are you getting the right holiday pay? Payruler, The working holiday maker tax rate is 15% until you earn $37,000. Tax rates for holiday visa makers (2025/2025) working holiday visa makers (subclasses 417 & 462) are under a specific tax system.

Working Holiday Tax Return (2025) Calculate your Refund!, For working holiday makers, from 1 july 2025, the 32.5% marginal tax rate. Australian resident taxpayers get the first $18,200.

Do You Know How To Hire A Holiday Worker? Tax Professionals, Govt considers rs 5 lakh tax exemption limit in new regime. They are taxed on a.

Tax Holiday vs Tax Allowance Taxvisory, From 1 january 2017, as a working holiday maker, you will generally not be entitled to the tax free threshold and will be subject to special tax rates, irrespective of whether you are. Currently, the lowest rate for foreign residents is 32.5% on taxable income of up to $120,000.

Do You Know How To Hire A Holiday Worker? Tax Professionals, For working holiday makers, from 1 july 2025, the 32.5% marginal tax rate. The working holiday maker tax table includes a flat rate threshold, which sets the tax rate at 15% for the first $37,000 in annual earnings.

Regular holidays, special nonworking days for 2025 bared, Australian resident taxpayers get the first $18,200. Should you travel to australia as a working holiday maker either on a 417 (working holiday) or a 462 (work & holiday) visa, the first $45,000 of your income is taxed at 15% and the.

Income range and tax rate when working for an employer registered as an “employer of working holiday makers”.

From 1 january 2017, as a working holiday maker, you will generally not be entitled to the tax free threshold and will be subject to special tax rates, irrespective of whether you are.